President Biden proclaimed April as Second Chance Month by declaring “America [to be] a Nation of second chances. [It] is critical that our criminal and juvenile justice systems provide meaningful opportunities for [Second Chances through] rehabilitation and redemption. It is vital that we address both the root causes of crime and the underlying needs of returning citizens using resources devoted to prevention, diversion, reentry, trauma-informed care, culturally-specific services, and social support. By supporting people who are committed to rectifying their mistakes, redefining themselves, and making meaningful contributions to society, we help reduce recidivism and build safer communities.”

At the Public Defender’s Office, we wholeheartedly support our clients by advocating to secure diversion opportunities and reentry services with community-based organizations such as the Anti-Recidivism Organization (https://antirecidivism.org/), ManifestWorks (https://www.manifestworks.org/), Los Angeles Centers for Alcohol and Drug Abuse (https://www.lacada.com/) and many, many more. We train and ready our staff to practice holistically, grounding our work in the knowledge that no one’s mistakes should be defining, and ensuring our clients obtain the necessary supports for successful reentry and to live a full and productive life.

Financial hardships often steer talented law students away from work opportunities that serve the public interest. Please consider making a tax-deductible donation to our post-bar law clerk, law clerk and internship programs. Your support is critical to train the next generation of passionate defenders. Your contribution will enable deserving recipients to provide clients their Second Chance.

Together, we can build the best defenders to serve the communities of Los Angeles County for decades to come.

Thank you in advance for your support.

Sincerely,

RICARDO D. GARCÍA

Public Defender

Emily Wingett

Santa Clara University SoL

Masters of Law Degree in Dispute Resolution from Pepperdine School of Law

Nicole Okung

Thomas Jefferson School of Law

Kozyak Tropin Throckmorton Litigation Skills Adjunct Faculty Award Recipient

2018-19 Innovative Service in the Public Interest Award

2017-2018 HOPE Pro Bono Challenge Outstanding 1L Award

Maddie Seales

University of Miami SoL

McGeorge Student Ambassador

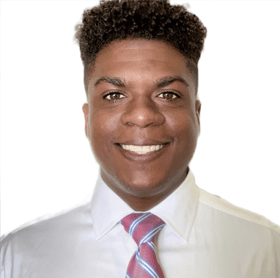

Marcus Williams

McGeorge School of Law, University of the Pacific

Robyn Loza

Trinity Law School

Madelaine Ambrus

UC Irvine School of Law

Public Service Award Recipient

Ivan Gonzalez

Loyola Law School, LA

2020 Nancy Stuart Public Interest Award Recipient

Jonathan Mendoza

UC Hastings Law

George and Katrina Woolverton Public Service Award

Hannah Mandel

Southwestern Law School

Mariapaola Santacruz Castro

Southwestern Law School

2020 Outstanding Clinical Student Award

2020 Dean's Service Award

2019 & 2018 Mexican American Bar Foundation Scholar

Stephanie Salceda

Loyola Law School, LA

Crystal Ventura

Pepperdine Law School

Adam O. Cohen

UCLA School of LawFor more information or if you’d like to further collaborate in achieving our Vision & Mission, please contact our Director of Strategic Growth & Development, Natasha E. Khamashta (562) 715-3410 nkhamashta@pubdef.lacounty.gov

Contributions or gifts to the County of Los Angeles or to any of its departments are tax-deductible if they are for public purposes. Los Angeles County is a chartered county and is a political subdivision of the State of California. The California Revenue and Taxation Code allows the same itemized deductions for California personal income tax purposes as are allowed under Internal Revenue Code Sections 170(a) and 170(c) (1) of the Internal Revenue Code which permit an itemized deduction for contributions and gifts to, or for the use of, a political subdivision of any State, if the contribution or gift is made for exclusively public purposes.

Los Angeles County’s Federal Identification Number is 95-6000927, and its California Tax Identification Number is 800-9593.